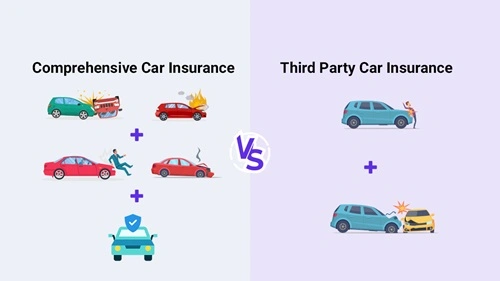

When it comes to motor insurance, understanding the differences between comprehensive insurance and third-party insurance is crucial. Both types of policies serve to protect you financially, but they cover very different risks and come with distinct features, benefits, and limitations. Here’s an in-depth comparison that outlines the key differences:

What is Comprehensive Insurance?

Comprehensive Insurance is an extensive type of motor insurance policy that provides coverage for a wide range of risks, beyond just damage or liability for third-party claims. Here are its main features:

- Own Damage Coverage: Covers damage to your own vehicle due to accidents, theft, vandalism, natural disasters, and sometimes even man-made calamities.

- Third-Party Liability: Offers protection against legal liabilities arising from injury or property damage caused to a third party.

- Additional Benefits: May include add-ons such as zero depreciation cover, engine protection, roadside assistance, and coverage for accessories.

- Higher Premiums: Given the broader coverage, comprehensive policies tend to be more expensive compared to third-party only coverage.

Pros:

- Extensive coverage for both your own vehicle and third-party liabilities

- Additional benefits such as roadside assistance or coverage for accessories

- Peace of mind knowing that a wide range of risks is covered

Cons:

- Higher premium costs

- Policy may include numerous add-ons which could increase the cost further

- Claims processing might be more complex due to broader coverage terms

What is Third-Party Insurance?

Third-Party Insurance is the minimum legally required motor insurance in many regions. It focuses solely on protecting you against liabilities arising from damage or injury to others (third parties). Key characteristics include:

- Third-Party Liability Only: Covers legal liabilities if you cause damage to another person’s vehicle, property, or injuries to another party.

- No Own Damage Coverage: Does not cover any damage to your own vehicle or losses due to theft, accidents, or natural disasters.

- Lower Premiums: Since it covers a limited range of risks, the premiums for third-party policies are generally much lower.

- Mandated by Law: In most jurisdictions, third-party coverage is mandatory to ensure that all drivers can at least cover damages to others in case of an accident.

Pros:

- Much lower premium costs compared to comprehensive insurance

- Compliance with legal requirements for motor insurance

- Straightforward coverage, making it easier to understand and manage

Cons:

- No coverage for repairs or losses to your own vehicle

- Does not provide additional benefits like roadside assistance

- Potentially high out-of-pocket expenses if your own vehicle suffers damages

Key Differences Between Comprehensive and Third-Party Insurance

The following table summarizes the main differences:

| Aspect | Comprehensive Insurance | Third-Party Insurance |

|---|---|---|

| Scope of Coverage | Covers both own vehicle damage and third-party liabilities | Covers only third-party liabilities |

| Damage to Own Vehicle | Included (accidents, theft, natural calamities, etc.) | Not included |

| Additional Benefits | Often includes add-ons (roadside assistance, zero depreciation, etc.) | Generally, no additional benefits |

| Premium Cost | Higher due to broader coverage | Lower, as it provides minimal protection |

| Legal Requirement | Not mandatory by law | Legally mandated in many regions |

| Claims Process | More comprehensive claim procedure that may involve multiple factors | Simpler claim process focused on third-party damage |

How to Choose the Right Policy for You

Selecting between comprehensive and third-party insurance depends largely on your personal circumstances, financial goals, and the value of your vehicle. Here are some factors to consider:

1. Value of Your Vehicle

-

Comprehensive Insurance: Ideal for newer or high-value vehicles. The cost of repairs and replacement parts can be very high, making comprehensive coverage worthwhile.

-

Third-Party Insurance: May be sufficient for older or low-value vehicles where the loss of value isn’t as significant.

2. Risk Exposure

-

Comprehensive Insurance: Best if you drive frequently in areas prone to accidents, theft, or natural disasters.

-

Third-Party Insurance: Suitable if you have a relatively low-risk profile and mainly need to fulfill legal requirements.

3. Budget Considerations

-

Comprehensive Insurance: Requires a higher premium, but provides peace of mind with broader coverage.

-

Third-Party Insurance: Offers a cost-effective solution with basic coverage. It helps reduce your outlay if you are comfortable with accepting the risk for your own vehicle.

4. Coverage Needs

-

Comprehensive Insurance: If you desire extensive protection that covers your car, additional accessories, and even offer value-added services.

-

Third-Party Insurance: If you are focused solely on meeting legal obligations without extra frills.

Real-World Scenarios and Decision Making

Imagine you own a new sedan with a high market value. The cost of repairs or replacement in the event of theft or an accident could be significant. Here, comprehensive insurance serves not only to protect against third-party liabilities but also to secure your investment in the vehicle.

On the other hand, if you own an older model car, where the market value has significantly depreciated, opting for third-party insurance might be a more economically sensible decision. You would still be complying with legal requirements while minimizing your premium outlays.

Conclusion

Understanding the differences between comprehensive and third-party insurance is vital before making a decision. Comprehensive insurance offers wide-ranging protection by covering both your vehicle and potential third-party liabilities, but it comes at a higher premium cost. Conversely, third-party insurance provides only the essential legal cover for injuries or property damage you cause to others, making it the more budget-friendly option.

Ultimately, the right choice depends on your individual needs, vehicle value, and tolerance for risk. Analyzing these factors carefully will ensure that you select a policy that best aligns with your financial and protective goals.

If you have further questions or need personalized advice, feel free to contact an insurance expert who can guide you based on your unique situation.